Diminishing depreciation rate formula

The DB function performs the following calculations. Depreciation Amount Declining-Bal.

Depreciation Formula Examples With Excel Template

Closing balance opening balance depreciation amount.

. Depreciation for a Period. The diminishing balance method of. Depreciation amount opening balance depreciation rate.

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. It uses a fixed rate to calculate the depreciation values. Year 1 2000 x 20 400 Year 2 2000 400 1600 x.

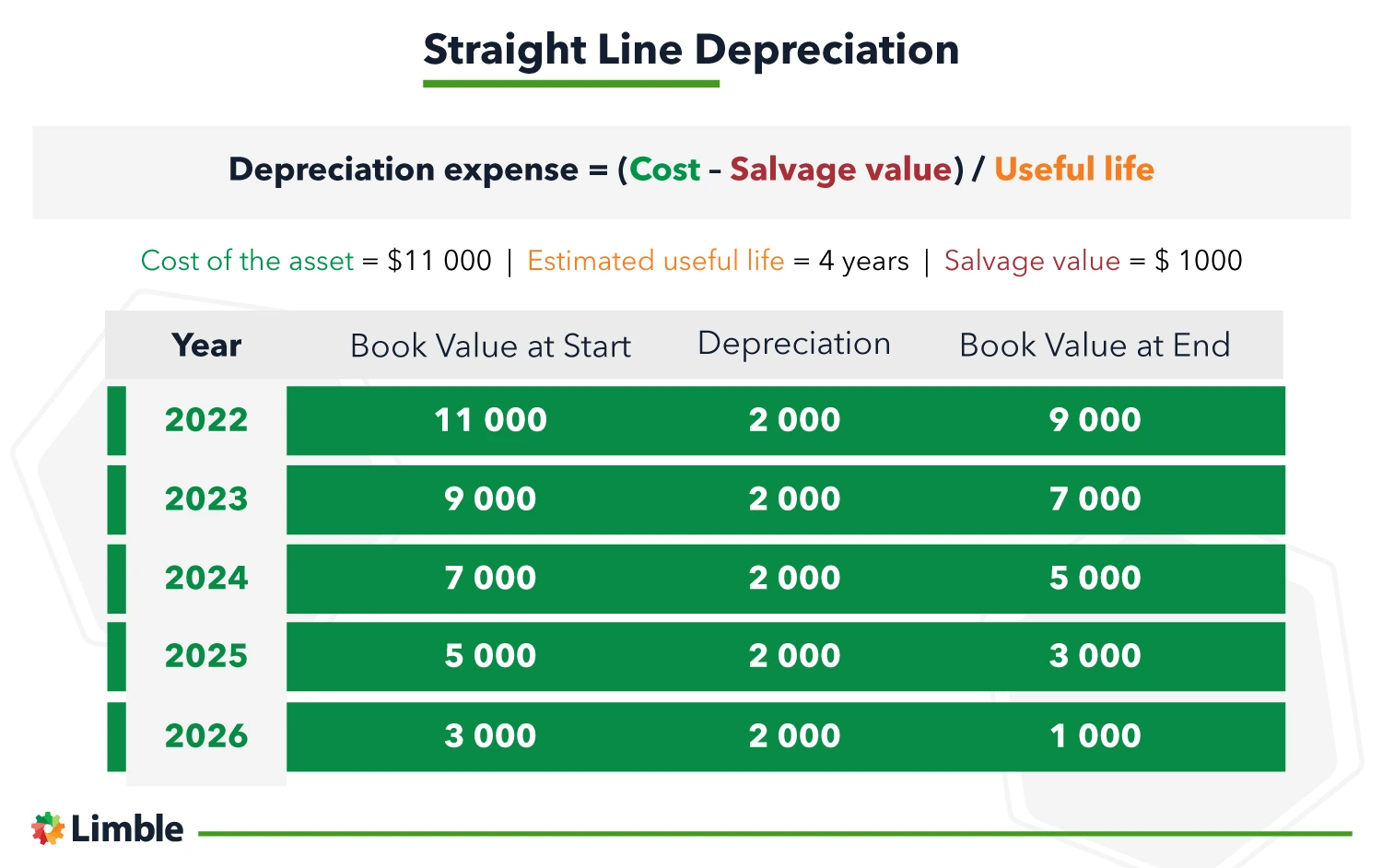

Straight-Line Depreciation Percent 100 Useful Life. The formula for the diminishing balance method of depreciation is. The rate of Depreciation 10 Year ending 31 March.

So Total Cost of an asset 110000015000050000 Rs 1300000- The following table shows the year by year. Hence using the diminishing method calculate the depreciation expenses. The rate of depreciation is 60.

Depreciation expenses Net Book Value. X Number of Depreciation Days x Depr. Depreciation 462500 x.

Depreciation 500000 x 10100 x 912 37500 2016. Depreciation Rate Depreciation Factor x Straight-Line Depreciation Percent. TextAmount of depreciation frac textBook Value times textRate of Depreciation 100 2015.

Depreciation amount 1750000. For the first year depreciate using the rate youve identified and the assets cost value how much it cost you to buy. Cost value diminishing value rate amount of depreciation to.

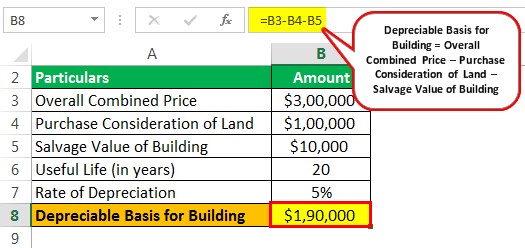

Base value days held 365 150 assets effective life Reduction for non-taxable use. Basis 100 x 360 The depreciable basis is calculated as the book value less posted. If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is.

Diminishing balance Method Actual cost of AssetRate of depreciation100 13700020100 Depreciation Amount for 1 st year will be 2740000 Similarly we can. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. Depreciation Rate Book Value Salvage Value x Depreciation Rate.

Fixed rate 1 - salvage cost 1 life 1 - 100010000 110 1 -. Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is- Depreciation. 2000 - 500 x 30 percent 450 Year 2.

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. Closing balance opening balance depreciation amount.

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Examples With Excel Template

Salvage Value Formula And Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Download Hr To Employee Ratio Calculator Excel Template Exceldatapro Excel Templates Excel Calculator

Download Sales Campaign Planner Excel Template Exceldatapro Excel Templates Excel Budget Template Excel Budget

Equipment Depreciation Basics And Its Role In Asset Management

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Examples With Excel Template

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Formula Calculate Depreciation Expense

Depreciation All Concepts Explained Oyetechy

Depreciation What Is The Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Calculator

Youtube Method Class Explained